Sal purchases a $1,000 piece of equipment, paying half of the purchase price immediately and signing a promissory note for the remaining balance. Sal’s journal entry would debit the Fixed Asset account for $1,000, credit the Cash account for $500, and credit Notes Payable for $500. To understand how debits and credits work, you first need to understand accounts. The book value of a company equal to the recorded amounts of assets minus the recorded amounts of liabilities.

Conceptual Framework for Financial Reporting

- The following example may be helpful to understand the practical application of rules of debit and credit explained in above discussion.

- Under the accrual basis of accounting, the Service Revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement.

- They play a crucial role in documenting and summarizing all financial transactions of a business in chronological order.

- From the banks point of view it owes the cash to the business and therefore has a liability.

- Totaling of all debits and credits in the general ledger at the end of a financial period is known as trial balance.

- This double-entry system provides accuracy in the accounting records and financial statements.

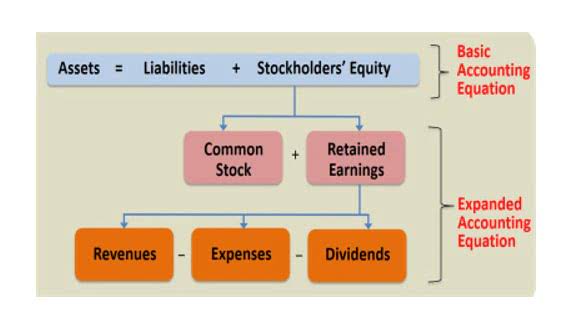

The basic system for entering transactions is called debits and credits. This seems hard, but it is a simple system that you can learn. Assets and expense accounts are increased with a debit and decreased with a credit. Meanwhile, liabilities, revenue, and equity are decreased with debit and increased with credit. Your bookkeeper or accountant should know the types of accounts your business uses and how to calculate each of their debits and credits.

Application of the rules of debit and credit

Janet https://www.bookstime.com/articles/best-recession-proof-business-ideas-to-start Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com. The amount of principal due on a formal written promise to pay.

- In summary the cash transactions the bank shows on the bank statement will be equal and opposite to those shown in the accounting records of the business.

- Train your staff so you can grow your business and post more transactions with confidence.

- In this case, we’re crediting a bucket, but the value of the bucket is increasing.

- The types of accounts to which this rule applies are liabilities, revenues, and equity.

- Second, all the debit accounts go first before all the credit accounts.

- If a company provides a service and gives the client 30 days in which to pay, the company’s Service Revenues account and Accounts Receivable are affected.

How does the formula for debit balance change in revenue/income accounts?

Debits and credits are bookkeeping entries that balance each other out. In a double-entry accounting system, every transaction impacts at least two accounts. If you debit one account, you have rules of debits and credits to credit one (or more) other accounts in your chart of accounts.

Journal entry examples

As a result these items are not reported among the assets appearing on the balance sheet. Things that are resources owned by a company and https://www.instagram.com/bookstime_inc which have future economic value that can be measured and can be expressed in dollars. Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles. Understanding debits and credits—and the fact that debits are on the left and credits are on the right—is crucial to your success in accounting. The difference between debits and credits lies in how they affect your various business accounts. Your goal with credits and debits is to keep your various accounts in balance.